Archived Why SERVPRO Blog Posts

What is covered with Business Insurance?

2/9/2023 (Permalink)

A business insurance policy can help you pay for the damages your company sustains and also helps replace any lost income due to a disruption. Some of these are obvious, while others might surprise you.

What is your potential loss?

The potential loss is the monetary value of property damage, lost revenue and profits, increased expenses and increased risk. For example, if you have a fire in your building that causes $100 million in damages, this is your potential loss. Your insurance company will then pay you up to this amount. To determine what your insurance policy limits should be for each type of coverage (such as property damage), consult with an independent commercial property & casualty insurance broker who specializes in business insurance policies for businesses like yours.

Property protection

The property protection section of your business insurance policy helps protect you against damage to the physical properties that are used to operate your business. Property can be damaged by fire, vandalism or natural disasters such as tornadoes, hurricanes and earthquakes. Additionally, coverage may include loss of use due to repair or replacement expenses. It also covers temporary relocation expenses if you're forced to shut down for an extended period because of damage from a covered peril. Keep in mind that coverage is only available while the property is being used as part of your business activity and not while it's vacant or under construction.

Business interruption insurance

The main objective of business interruption insurance coverage is to keep your business afloat in case of a covered disruption. If a fire or flood destroys the building where you operate, this type of insurance would reimburse you for lost revenue during this period.

In addition to reimbursements for lost revenue and any physical damages sustained, some types of business interruption insurance also cover the costs associated with hiring replacement workers while yours are out of commission. It’s important to inventory all the physical assets lost so that they can be replaced. You may also want to consider getting excess property coverage that covers additional property that isn't included under basic property insurance policies (e.g., tools or machinery).

These are the expenses that could be covered by the policy.

Business insurance covers the cost of repairing or replacing damaged property, as well as restoring the site to its original condition. The policy may also include a provision that allows you to hire a contractor to repair or replace damaged equipment.

Depending on your business and location, additional coverage could be required under state law. In addition, some businesses are required by law to have workers' compensation insurance or pay into unemployment funds in certain states or provinces—this is beyond what is included in most business policies.

If you are still unsure about whether or not your business needs coverage, contact an insurance professional who can help determine the right amount of insurance for your business.

4 Common Places To Find Mold Growth in Your Home

8/25/2022 (Permalink)

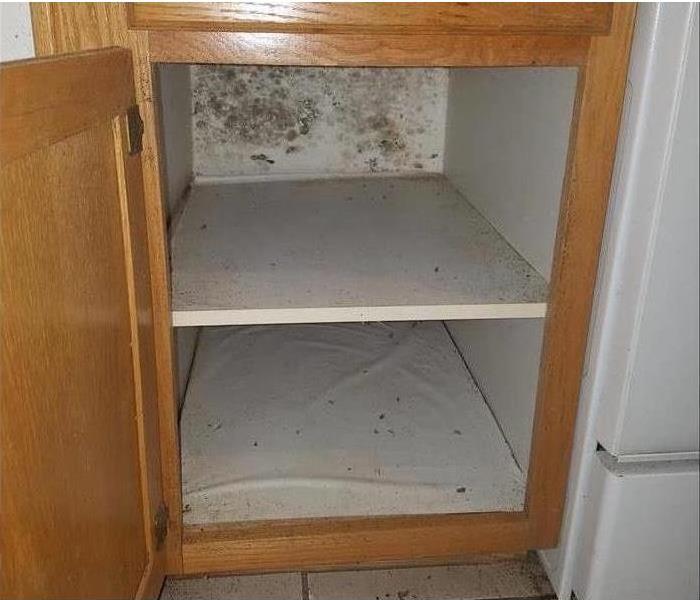

Mold growth inside cabinets.

Mold growth inside cabinets.

Four Places You Might Find Mold

Mold damage is pretty common with homes, especially ones with humidity or moisture issues. Fungal spores thrive on dampness and organic matter such as paper, carpet, and wood; therefore, they are likely to grow where these factors are present. To catch issues early, homeowners in Big Bear, CA, should keep a vigilant eye on the following four places.

1. The Bathroom

Mold and mildew growth are often noticed within the bathrooms, especially within the shower. Moisture is often in excess here and resides on the tile. While the ceramic or porcelain may be harder to penetrate, the grout itself is vulnerable to droplets. Residents are likely to see growth within the lines.

Fight it off by using a squeegee after you shower. Also, run the fans for at least 20 minutes after, pulling out as much wetness as possible. Recaulk often to avoid weaknesses in the grout lines.

2. The Closets and Cabinets

Mold damage may happen in the corners of closets or inside cabinets. These locations may have water exposure from pipes and remain dark often: a perfect habitat for the organism. If discoloration is noticed, call a mold remediation company to evaluate the trouble. The area should be inspected, and the impacted drywall torn out and replaced.

Combat trouble by keeping closets cool, running fans in the bathrooms, and using moisture-absorbent products in cabinets.

3. The Kitchen

When the oven is going, heat builds. This environment assists in building humidity and mold growth. Keep the oven fans going and run the air handler. Be aware of how much you're running appliances and check the plumbing for rust, leaks, and corrosion.

4. The Air Handler

The air conditioner is a protective device against mold, assisting in maintaining a cool, dry space. It also moves the air from room to room and takes on dampness. Mold can multiply within the pipes, spreading to other locations. Have the system cleaned and checked regularly.

Mold damage likes hiding in places you don't often look. Those tiny spores cling easily, reproducing where water and organic structure meet. Be proactive, and keep a lookout for early stages.

What To Look for in a Large Loss Response Company

7/26/2022 (Permalink)

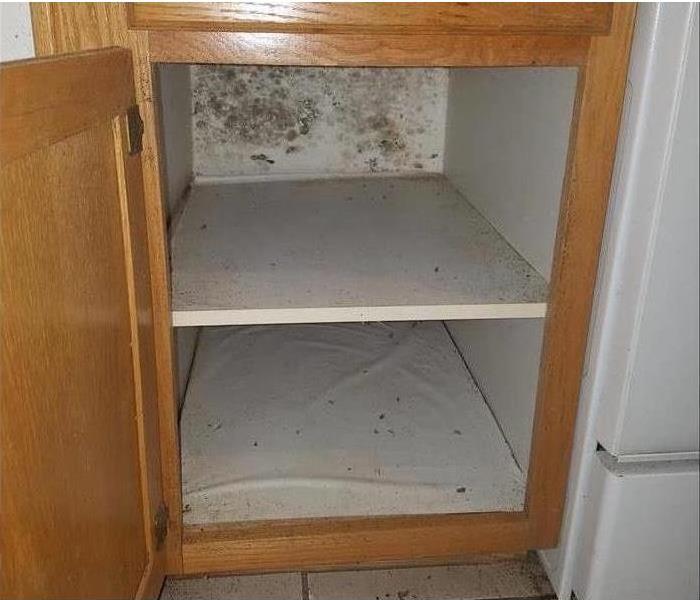

If you have experienced storm damage in your business it is important to choose the right large loss restoration company.

If you have experienced storm damage in your business it is important to choose the right large loss restoration company.

Large events call for an extraordinary service team. However, do some due diligence to find the right company. From blizzards to flooding, there are a few things you must look for to find a large loss contractor that can restore the damage, minimize downtime, and lessen your losses.

Many Industries Served

Many types of businesses in Yucaipa, CA could benefit from a large loss contractor. Check a company's past work history and look for experience in the following:

- Apartments

- Office buildings

- Corporate facilities

- Banks

- Medical facilities

- Hotels

- Condominiums

- Homeowner's associations

- Churches

- Shopping centers

- Schools

- Manufacturing plants

- Insurance headquarters

- Bars

- Government buildings

Large Loss Program

Finding a company with a large loss program can ensure you are in good hands. This is because someone with a catastrophic loss program will have a team ready to go with specialized equipment and experience with fire, smoke, water, and mold mitigation and restoration. They will also have experience coordinating with large businesses and managing projects of this size.

Trusted Reputation

You want your catastrophic loss team to be composed of the best managers and technicians available. Therefore, you want a disaster remediation company with a top-notch reputation. A company that is trusted will have competent and experienced professionals working for them. Word of mouth, recommendations from your insurance company, and online reviews are the best way to get a feel for a professional's reputation. Checking these sources lets you find the best company.

Detailed Restoration Process

After a disaster, there will be a lot of challenges you need to face. Therefore, it is a good idea to find a company that provides a detailed restoration process. They should be able to help you through everything from structural damage to content cleaning. They will also explain each step of the catastrophic loss restoration process so you know what to expect.

Whether you experience storm damage or another type of disaster, it is important to choose the right large loss restoration company. Following these tips will help you choose the right professionals for your business.

How To Get the Most Out of Your Insurance Claim

6/1/2022 (Permalink)

How To Maximize The Value Of Your Insurance Claim

Disaster claims can be stressful. Knowing the process for dealing with an insurance claim can help you get a settlement quicker, so you can hire a remediation company, such as SERVPRO, and get your Redlands, CA, business open again. Being prepared ahead of time can also help you get more out of your insurance company. Here are some steps to take for a quick and thorough settlement.

React Appropriately

Right after your loss, things are going to be chaotic. While you need to think about contacting your insurance company promptly, you should also take the time to react to the situation properly. This includes:

- Preventing further loss

- Salvaging items

- Photographing the damage and compare it to your inventory list

- Avoiding throwing items away

Know Your Policy

Your policy has several key aspects that will be outlined on your declarations page. This document is confusing, so take extra time before a disaster to read and understand it. This can help the insurance claim process go smoother when you experience a disaster.

Call the Insurance Company

The biggest mistake a business owner can make in the face of a disaster is to delay making your insurance claim. Therefore, your first call should be to the insurance company to figure out your deductible, what will be covered, and what disaster restoration service they recommend.

Expect Extra Funds for Business Interruption

If you have a business interruption clause on your policy, you can expect extra funds for that. This will cover your lost income when you need to shut down your business and any extra expenses you have due to the interruption. This can include funds for new communication lines, a temporary location, extra transportation costs, or anything else you would not have incurred without the disaster.

The best way to get the most out of your claim is to understand the process and react appropriately. Additionally, you can discuss your extra clauses with your insurance agent and ensure you get any funds you are entitled to.

Why Insurers Appreciate Electronic Claims Services

5/1/2022 (Permalink)

Why Do Insurers Value Electronic Claims Services?

Insurance companies process many claims every day, some of which are easier and faster to approve than others. The availability of accurate information about property damage is a determining factor for the speed and ultimate success of insurance claim approval. Find out how the SERVPRO Claims Information Center can support damage claims for properties located in Yucaipa,CA.

Reliable Access To Information

Insurance agents and adjusters must be able to access information about property damage to process a claim. All of the following elements should be included in a job file:

- First notice of loss

- Documentation of damage

- Forms and paperwork

- An itemized estimate

A notice of loss is required to file an insurance claim, as is documentation of damage taken prior to mitigation. The Claims Information Center makes all of this information available upon processing by a restoration franchise. These digitized materials and other helpful resources can be accessed online at any time through the same convenient service.

Faster Job Progress Updates

As certified professionals make progress on mitigating, cleaning and restoring damage, information about ongoing work is also updated on the Claims Information Center. An insurance agent or adjuster can check in on the status of a job at any time during claim processing.

Industry Standard Performance Comparisons

One of the best features of working with a large restoration company is the availability of information from other jobs in the same area and nationwide. Insurers can compare the performance of a franchise location to industry standards for damage restoration work.

The accuracy and availability of information are the two most important factors for successfully settling any insurance claim. Property owners may prefer to retain the services of restoration professionals who use electronic claims services for restoring homes or commercial buildings in Yucaipa,CA, and most insurers seek out Preferred Vendors with access to the SERVPRO Claims Information Center.

What to Know About the IICRC

2/7/2022 (Permalink)

What You Should Know About The International Committee Of The Red Cross (IICRC)

The Institute of Inspection, Cleaning and Restoration Certification, also known as the IICRC, is an important organization responsible for setting standards for the property restoration community including those in Mentone, CA. Here are a few details about this organization you may wish to know.

1. Who They Are

A non-profit organization, this institute seeks to serve the cleaning and restoration community. There are 15 industry leaders chosen to sit on the board of directors. These professionals help ensure that the organization runs smoothly in a direction that represents the interests and standards of the industry, and help shape the recognized policies.

2. What They Do

The IICRC sets a series of standards recognized by federal, state, and local authorities for the cleaning and restoration industry. These standards are meant to ensure that every job is conducted with the safety of both building occupant and restoration team in mind, and that each project is completed with quality results. This organization also provides education and certificate training.

3. How They Serve

By creating industry standards and providing a mitigation certificate to those individuals trained in these policies through one of the many provided programs, this organization helps insure that those in the industry all work to a set standard. Standards help ensure that there is no confusion about the steps necessary to properly complete a job, and allows clients to know what to expect their chosen professional to do during restoration.

The standards set by the IICRC allow you to know that the professional restoration team chosen to work on your client’s property can perform the job to the same degree of excellence you seek to provide yourself. This non-profit organization seeks to provide globally set standards for every restoration professional to follow, ensuring that every job is performed with quality results. Choosing a certified professional can allow you to know what to expect from any restoration job.

24/7 Emergency Service

24/7 Emergency Service